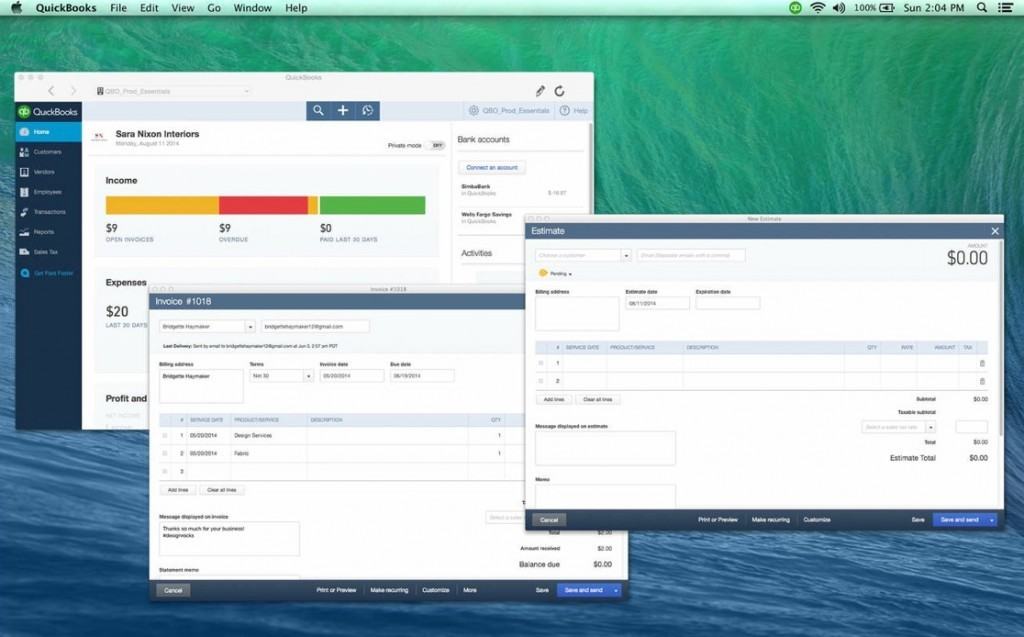

Best Desktop Accounting Software For Mac

Identifying the best personal finance software for you based on which platform you use the most (desktop, online, Mac, iPhone, Android, BlackBerry, etc.) can be a daunting undertaking, especially due to the hundreds of budgeting, personal finance, money management, and savings software sectors. First on our list of 20 best accounting software for Mac is FreshBooks, which is a popular accounting software that makes financial management an easy undertaking. Using the solution, you can handle recurring subscriptions and invoices with relative ease.

There are a growing number of accounting software applications for today’s small business. Some are designed for specific industries (e.g., construction or professional services), while others are tailored for specific business sizes, with varying levels of functionality. In addition, buyers will need to consider what deployment model and integration method is most cost-effective for their company. Given all this, it can be tricky for small businesses to identify the right accounting software for their needs. We developed this guide to help buyers understand exactly what these products offer, so they can select the solution that is the best fit. Here's what we'll cover: Common Reasons Small Businesses Seek Accounting Solutions Thousands of small businesses contact us every year looking for help selecting the accounting solution best suited to them.

Some of these buyers are just getting started, while others are looking to replace an outdated or problematic system. Small businesses most commonly purchase an accounting system because they are: • Seeking to upgrade to a software system with more advanced features. • Seeking to automate functions that were previously done manually. • Looking to. • In need of specific features (e.g., project or job accounting). • Frustrated with their current accounting software (e.g., it is not user-friendly).

Common Features of Small Business Accounting Software There are several different applications for buyers to choose from, which can be purchased either as a standalone application or along with other related applications, as part of an integrated software suite (more on this below). Make sure the system you purchase covers all the functionality you’re going to need. Here are some of the most common small-business accounting applications: Application Function Best for.

/ (AP/AR) The fundamental bookkeeping application, which as well as what the company owes its suppliers, also known as its liabilities (accounts payable). All small businesses (especially those without a dedicated bookkeeper); this is an essential accounting function. Financial reporting Reporting applications allow businesses to export data from their accounting system in a structured manner that communicates financial history as well as financial projections. Some may include compliance-related functionality for government or industry audits (e.g., in banking and financial services). Any small business with seasonal or otherwise dynamic cash flow that needs to be tracked closely.

Also, businesses that need to provide financial reports to stakeholders or to regulatory institutions for compliance. Budgeting & forecasting Budgeting applications allow small businesses to model potential financial outcomes and to compare actual profit and loss to planned budgets, which helps with decision-making about workforce, spending and growth. Some systems have dashboards that display information visually. Small businesses that are currently growing or considering expanding.

Samsung ssd for mac pro 2013. Due to the nature of SSD, they have limited lifetime. They are pulled from a system but have a similar price. Buying used SSD you never know how long it was in use and you are taking a big risk.

Fixed asset accounting Fixed asset applications focus on tracking assets that aren’t easily converted to cash: For a small business, assets will typically be “tangible,” such as land, buildings or equipment. These applications calculate the value of such assets over time, allowing for depreciation due to wear and tear. Small businesses with substantial tangible assets, or any business that, for tax purposes, may benefit from reporting depreciations to assets. Pricing: Web-Based vs. On-Premise Accounting Software Most small businesses will want to consider cloud-based accounting solutions. Because these systems are hosted online by the vendor, they eliminate the need for you to have a dedicated IT team for managing and maintaining your own server. Conversely, an “on-premise” deployment means the software is hosted locally, on your company’s own servers (which you are responsible for maintaining).